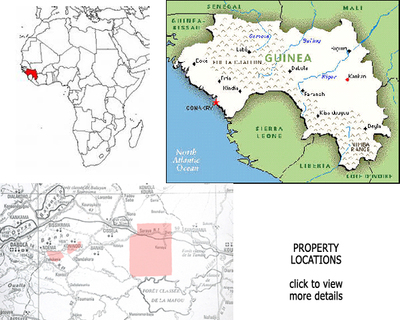

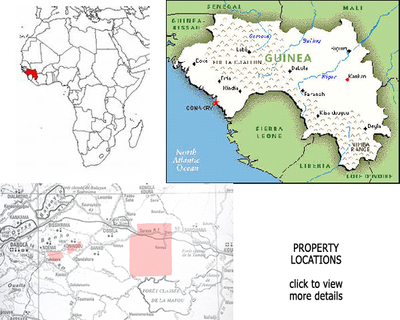

10-Q: Farm Lands of Guinea, Inc.

- MENAFN

- 16 August 2011

Fact sheet on FLGI, filed with US government. Points out that Guinea's Ministry of Agriculture has granted the firm exclusive marketing rights, with a commission of 15% payable on closed sales, to the 1.5 million ha of farmland FLGI agreed to survey.

.jpg?1311677061)