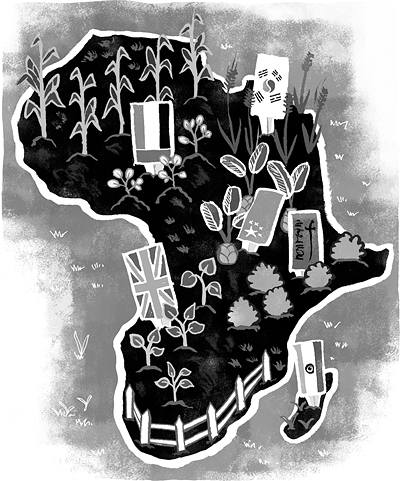

Food security fears drive fund farm investments

- Reuters

- 02 July 2009

The emergence of the farmland asset class is not without pitfalls with the provision of food always highly political and a tentative global economic recovery potentially threatened by the H1N1 flu pandemic, fund managers said.