Doit-on protéger nos terres?

- RDI

- 17 Mar 2010

Selon l'économiste Marc Urbain Proulx, les groupes chinois sont prêts à contourner la loi en faisant acheter les terres par des personnes qui résident au Québec.

Selon l'économiste Marc Urbain Proulx, les groupes chinois sont prêts à contourner la loi en faisant acheter les terres par des personnes qui résident au Québec.

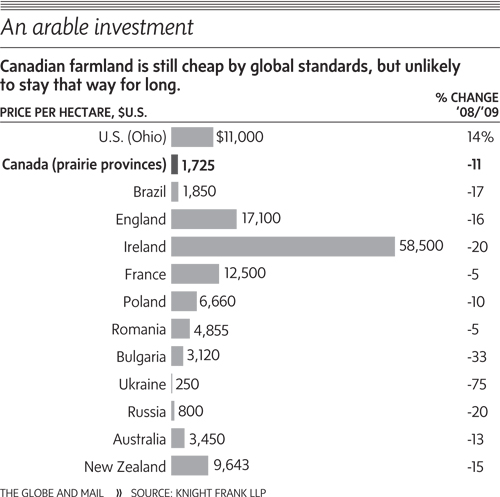

Une filiale américaine de la Financière Manuvie qui a récemment fait une percée au Québec en achetant des terres agricoles totalisant 450 hectares dans les Bois-Francs affirme qu'elle est venue au Canada avec la ferme intention d'y rester et d'y prendre de l'expansion.

Hancock Agricultural Investment Group, a Boston-based unit of Toronto's Manulife Financial Corp., decided its first Canadian purchase would be an 1,100-acre (450-hectare) patch of land that it called "one of the most highly productive properties in the industry." The company will not disclose how much it paid, or even the exact location of the farm. But president Jeff Conrad said the company is in Canada to stay, and the fund plans to seek more land.

Aimed at public and private market investors, this conference will explore opportunities for global investments in agricultural lands, commodities and infrastructure in North and South America, Australia, China, Eastern Europe, Southeast Asia and sub-Saharan Africa.

The debate over foreign investment is set to expand from the mining industry to agriculture as overseas investors pour billions of dollars into Australian rural properties considered by some to be strategic national assets.

As with timberland, while direct ownership and management (i.e., being a farmer), is a possibility, such a route is similarly fraught with difficulties. One of the most significant of these is the issue of diversification in the farmland itself - especially with a single investment. A well-diversified holding of farmland (row crop, permanent crop, pasture and even timber) will, therefore, not only require a significant investment, but may also involve land holdings in a number of different locations.

Gobal fund manager Schroders is launching an Agricultural Land Fund, only months after closing its USD 6 billion Alternative Solutions Agriculture Fund due to excessive investor demand.

The cooling domestic equity and bond markets has prompted endowments and foundations to give niche alternatives, such as farmland, a closer look.

|

CAR offers land ownership using cryptocurrency

|