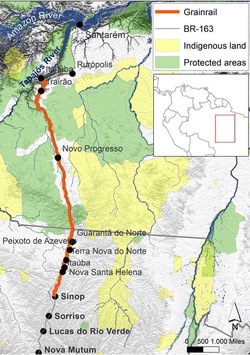

Map of Grainrail showing its current planned starting point at Sinop in Mato Grosso, and its originally proposed terminus at Lucas do Rio Verde further south, as well as its destination on the Tapajós River to the north. (Image by Mauricio Torres)

Grainrail: ‘2nd revolution in Brazilian agribusiness’ and Amazon threat

by Sue Branford and Maurício Torres

TRAIRÃO, Pará state, Brazil – A controversial new railroad, Ferrogrão (Grainrail), is poised to penetrate the Brazilian Amazon, if industrial agribusiness gets its way. The planned infrastructure project is heavily backed by soy farmers who say it will radically reduce freight charges, allowing for large-scale soy cultivation in the very far north of Mato Grosso state, an area now largely inaccessible to commodities transport. The rail line is also heavily backed by transnational commodities firms such as Cargill, Bunge and Amaggi, who stand to profit.

The project will lead directly to “a second revolution in Brazilian agribusiness,” declared Tarcísio Gomes de Freitas, the Secretary for the Coordination of Projects in the federal Programme for Participation in Investments (Programa de Participação em Investimentos).

The Secretary told Mongabay that Grainrail could initiate the next stage in Brazil’s soy boom, bringing a timely and profitable crop expansion – coming just as the U.S., a leading soy producer, intensifies its trade war with China, a major consumer of Brazilian soy.

Environmentalists, indigenous peoples and their supporters, fiercely oppose Grainrail, noting that it will threaten two biomes, the Amazon rainforest and Cerrado savannah. It will, they say, likely have harmful impacts on three indigenous groups and open 14 protected areas to illegal intruders, including loggers and ranchers.

Opponents fear that the railway will further accelerate what they see as the uncontrolled land grab already underway in the region. Grainrail will traverse a portion of the Brazilian Amazon with one of the highest rate of deforestation, an area also prone to a frightful level of violence.

Grainrail: why agribusiness wants it

In February 2017, when we reached the outskirts of the small town of Trairão in Pará state, it seemed as if we had crossed into an unstable frontier territory where the normal rules of everyday modern life had broken down, where people were fending for themselves as best they could. It felt like a ticking time bomb, maybe about to explode into violence.

The unsettled scene that greeted us was also a picture-perfect argument of why farmers and commodities companies so badly want Grainrail.

For days, about 4,000 truckers and their loads of soya had sat stranded in a 50-kilometer- (30-mile)-long traffic jam caused by drenching Amazon rains coinciding with the harvest, and turning a 100 kilometer (62 mile) stretch of the BR-163 into an impassable mud-hole.

The highway links Cuiabá in Mato Grosso – the interior plain where much of Brazil’s soy is grown – to the port of Miritituba on the Tapajós River, where the soy is shifted from the trucks onto sea-going vessels for a trip down the Amazon River, followed by transoceanic export to the European Union and China.

Although most of the truckers were peacefully playing cards or resting in hammocks, they had grown short of food and water, and the mood was insecure, and edging toward violence as tempers flared. Though mostly the truckers dozed – sleeping in hammocks slung across their truck chassis, playing cards or chatting quietly in small groups.

The municipal government of Trairão had declared a state of emergency and the army and federal traffic police had been called in. Even the locals were running out of basic supplies and fearful of what might happen if relief didn’t arrive soon.

The truck owners had received a pay increase due to the delays. But while that benefitted drivers who owned their vehicles, it didn’t necessarily trickle down to hired truckers. Instead of the normal R$170 (US$43) for each ton of soy transported, they were now earning R$200 (US$50).

Despite that raise, many were reluctant to take another load. “When you add it all up, there’s nothing left because the road takes all your money,” said one frustrated driver. “Tires get damaged, the truck gets twisted, the suspension breaks. Everything breaks.”

Frustrated soy producers say it’s absurd to endure these on-going logistical problems in transporting soy – the country’s biggest export crop, responsible for 12 percent of overall export earnings. In a long, frank interview, Antonio Galvan, president of the Mato Grosso branch of APROSOJA (the Association of Soy and Corn Producers), a leading agricultural lobby, told Mongabay that it isn’t just the truck drivers who lose out.

“The damage spreads out all over Brazil, in a chain reaction, because we can’t fulfil our export contracts,” Galvan said. The nation needs urgently to invest in new infrastructure, he added, if industrial agribusiness is to profit by serving expanding foreign markets.

An alternative socio-environmental view

Some analysts say there’s another way of looking at the problem. Mato Grosso state, Brazil’s main soy-producing region, was opened up very recently, they point out. It was just over a decade ago when farmers gambled on growing soy in large quantities in Brazil’s interior, thousands of kilometers from seaports, and they did so without the needed infrastructure to get the crop out.

Since then, the government has invested quite heavily in infrastructure. It has paved thousands of kilometers of road with considerable speed, while commodities companies have constructed massive river-ports. Although bottlenecks like the one we experienced in Triarão still exist, more and more of the soy produced in the north of Mato Grosso is today being transported along the quicker northern route to the Amazon estuary, instead of going via the slower 2,000-kilometer (1,200 mile) southern route to the Atlantic ports of Santos or Paranaguá.

Indeed, to some, the chief absurdity is not the temporary bottlenecks but the extraordinary haste with which the government wants to implement the new infrastructure, without proper consideration of the damage to the environment, or indigenous and traditional communities.

“New roads, railways, dams and shipping routes will inevitably aggravate the serious problems of deforestation and create new social-spatial tensions,” said Antonio Ioris, from the University of Cardiff. “Once again [the authorities] are invoking an obtuse productivist logic, according to which ‘the more production, the better’ without questioning the long-term consequences. Agribusiness is defended as if it were unquestionably a benefit to the whole population, ignoring the fact that its unbridled expansion leaves a legacy of environmental degradation and even more poverty.”

This year, logistical problems have eased slightly, as the paving of the BR-163 nears completion. But few in agribusiness see the road as a long-term solution: “The BR-163 is [already] operating at over-capacity,” complained APROSOJA’s Galvan. “It’s far too congested, and they’re coming up with mad ideas. They’re even talking of introducing trucks with eleven axles! Can you imagine it? They want to turn a truck into a train! It’s absurd!”

It is against this background that the Brazilian government announced plans in 2016 to build a new railroad, 934 kilometers (580 miles) long, to run parallel to the BR-163, from the town of Sinop in Mato Grosso to the port of Miritituba on the Tapajós River (see map). According to the government body ANTT (the National Agency of Land Transport), Grainrail will be able to handle 58 million tons of commodities annually – operating throughout the rainy season, and producing less greenhouse gases than soy-loaded trucks.

At first glance, it seems that Grainrail is a project that should please everyone: farmers get cheaper freight, the population gets a new transport option, and environmentalists get a cleaner form of transport. But a closer look shows that the issue is far more complex.

Grainrail – who wins, who loses

Although there’s been talk of Grainrail for years, it is the Brazilian businessman, Guillerme Quintella, who is finally getting the project underway. The dynamic 57-year-old is president of Estação da Luz Participações (EDLP), a private consultancy specializing in transport and logistics.

He also heads a consortium set up by high powered, multi-billion-dollar commodities traders, including the so-called ABCD transnational grain traders (ADM, Bunge, Cargill and Louis Dreyfus), as well as leading Brazilian soy trader, Amaggi – all of whom want to build and run the new railway.

In May 2017, Quintella declared: “There is nowhere else in the world that produces as much as Mato Grosso, and yet [the state] doesn’t have decent infrastructure.” He is adamant in his boosting of Grainrail as the best medium term solution to the soy transport problem.

Even though the required investment is huge, estimated at R$12.7 billion, Quintella has repeatedly said that raising the money is no impediment. Tarcísio de Freitas confirmed to Mongabay that Brazil’s large development bank, the National Bank of Economic and Social Development (BNDES), would provide 70-80 percent of the capital.

The advantage in getting BNDES money, he explained, comes not from low interest rates, because such loans are no longer heavily government subsidized, but because of the much longer repayment periods the federal bank can offer. BNDES “can increase the grace period from five years, to six or eight, and can stretch the repayment period to 25 or even 30 years,” said Tarcísio de Freitas.

When bidding for the construction contract begins, likely next year, there may well be no competition. Early reports suggested that the Chinese might make a solo bid, but sources in Brasilia told us China will probably now join the consortium being set up by the transnational grain traders.

But even with the money and the construction team in place, a stumbling block remains: Brazil’s lack of economic and political stability. “We get businessmen and investors interested, and then they take fright at Brazil’s lack of stability,” Quintella said.

Still, he has persisted. In 2013, Quintella commissioned a preliminary study of Grainrail’s viability. It produced two projections for soy transport logistics in 2030 in the north of Mato Grosso and Pará states – one without Grainrail and another with Grainrail.

With Grainrail, the share of crops (projected at 54.4 million tons annually) carried on roads would fall from 59 percent to 13 percent, while the share carried on trains would increase from 39 percent to a whopping 87 percent. This would be a dramatic shift in the region’s transport logistics, side-lining trucks and bringing rail to the fore.

The study predicts that, if Grainrail is built, the BR-163 highway will not carry any crops at all in its northern stretch. “The BR-163 in Pará state will see an enormous reduction in freight flows, as this freight will migrate to Grainrail,” Quintella confirmed.

While this is good news for top players (particularly industrial agribusiness and commodities traders), it is bad news for small players, especially the 10,000 truckers who drive the BR-163, and for the many shops, gas stations, bars, restaurants, hotels, and repair shops scattered along the highway.

Places like Triarão would suffer greatly. That’s likely why many tradesmen we talked with were vociferously opposed to the railway. A stoic cabdriver said: “I think the railway would be better for the country than the road, but for us, who live off the road, everything will get much worse for it’s the money that the truckers bring in that keeps the town afloat.”

Grain transport monopoly?

Early maps of Grainrail make clear that the original plan was to extend the line southward to Lucas do Rio Verde, a town in the heart of the soy boom where the government hoped to establish a major national rail hub.

However, earlier this year, when the government published its Plano Nacional de Logistica – 2025, an inventory of needed infrastructure improvement investments, Grainrail was present, but with an important difference. Now the end of the line is 150 kilometers (93 miles) further north in Sinop, at the far northern edge of the soy boom – where no rail junctions exist or are planned.

This seems surprising, being that a fundamental goal of federal governments is to establish integrated railway systems. Ending Grainrail well short of Lucas do Rio Verde seems to go against the national interest.

Mongabay asked Quintella, who heads the transnational consortium, why this decision was made, but his answer failed to enlighten: “[T]he stretch [of Grainrail] that is initially viable is as far as Sinop,” he said. “It might be extended once this first stretch is concluded.”

Edeon Vaz Ferreira, of the Pro-Logistics Movement of Mato Grosso, explained the paradox: “The [construction and operating] consortium doesn’t want Grainrail to be integrated into the national rail network, because, if this happens, under Brazilian law, it has to allow other companies to use its line.” But if the line terminates at Sinop, the consortium can hold a monopoly and stop other companies from using the line to transport other goods, such as mining ore or passengers.

Ferreira agreed that a complete monopoly is the practical result of a decision to halt the line at Sinop, something that would appear to go against the government’s wish to develop the region. He explained why the government didn’t object: with such a shortage of investment capital in Brazil, the government isn’t in a position to impose demands. “To tell the truth, we want this railway,” he said. “If we start creating many problems for them [the transnational companies], they are going to give up and we will be left in the lurch.”

Galvan expressed little surprise that the transnational commodities firms are refusing to democratize access. According to him, Brazilian farmers are already beholden to the big commodity traders: “They already hold us hostage. They operate a cartel for seeds, for fertilizers, for the prices they pay us for our crops. And the cartel is always squeezing more and more. Each year farmers are leaving [the sector]. You can only survive if you have your own resources and don’t need to accept their conditions.”

A dream of industrial waterways

Galvan explained that over the longer term, for farmers to stay profitable, it will be essential to break the Grainrail monopoly: “If we don’t have competition, freight charges on the railway will remain as high as on the road,” he said. Quintella agreed: “The only way to reduce freight charges is through increasing the number of efficient [transport] alternatives.”

And the best of all possible alternatives, Quintella, Ferreira and Galvan agree, would be to build a system of industrial waterways in the Amazon’s Tapajós basin. This view is also strongly held by Agriculture Minister Blairo Maggi, perhaps because Amaggi, the family firm, is heavily invested in water transport.

“It’s very important that we create competition between waterways and railways because then you can keep down freight charges,” Ferreira told us. In an earlier interview, he pointed out that a farmer in Sorriso, Mato Grosso, spends US$112 to move a ton of soy to the port of Santos and then to Shanghai, China. But a US farmer, using competing railways and waterways, spends just US$51, even though the distance travelled is comparable. “The [transport] competition [in the US] is phenomenal!” he concluded.

Of course, turning the Amazon’s flowing rivers into industrial waterways would be hugely harmful to ecosystems, requiring extensive river dredging and the destruction of rapids. And, if the waterways were built in conjunction with hydroelectric power stations, as is likely, the dams, locks and manmade lakes would disrupt both aquatic and terrestrial ecosystems (which rely on annual Amazon flood pulses for nutrients), likely wreck commercial fishing, while displacing riverine communities, and adding dramatically to carbon emissions to the atmosphere due to methane release from rotting tropical reservoir vegetation.

Industrial waterway plans are fiercely opposed by environmentalists, biologists and indigenous communities. Waterways “would directly affect conservation units, indigenous land, traditional populations, ecosystems and the climate,” concluded one study.

Prospects

The battle over industrial waterways lies in the future. At present, the bancada ruralista agribusiness lobby in Congress simply wants to get Grainrail construction underway. But prospects have dimmed in recent weeks. Whereas Quintella had been confident that construction bidding would be held this year, he has now told us that it has been postponed until 2019.

Although he didn’t say why, it seems the project has again stalled due to Brazil’s political and economic volatility. With the strong possibility that a maverick right-wing politician, Jair Bolsonaro, will be elected on 28 October, investors may be holding back.

Having now gained the support of the ruralist agribusiness lobby, Bolsonaro has radical plans for Brazil. He says he will abolish the environment ministry, including IBAMA and ICMBio (the Chico Mendes Institute for Biodiversity Conservation), dilute indigenous land rights, and possibly exit from the Paris Climate Agreement. These proposals, welcomed by some, would be fiercely opposed by environmentalists and others, likely causing political fallout and perhaps further deterring foreign investment.

This is the fascinating, behind the scenes story regarding Grainrail’s difficult birth. But there is another story to be told – that of environmentalists and trade unionists who reject the project, and the subject of a later article.