Abu Dhabi is preparing to launch a large-scale agricultural project in Sudan to develop more than 70,000 acres of land as part of the oil-rich Gulf emirate's efforts to secure food supplies.

The project comes amid growing interest from Middle Eastern states to use land overseas to ensure food security. Saudi Arabia and Egypt have also held talks with Sudan and are considering agricultural projects of their own in Africa's largest nation, officials confirmed yesterday.

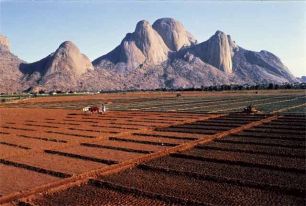

Sudan has vast but underdeveloped agricultural resources and has been described as a potential bread basket for the Middle East.

Robert Zoellick, president of the World Bank, said Riyadh - which plans to phase out domestic wheat production by 2016 to preserve its finite water resources - had asked the institution for help with plans to invest in agricultural projects abroad.

"They have asked us to connect [Saudi Arabia] with countries in Africa and central Asia," Mr Zoellick told the Financial Times in Rome.

Cairo was considering a venture with Sudan in the Gezira scheme, an Egyptian official said, which was started by the British in the 1920s and was one of the world's biggest irrigation projects. Both the White Nile and the Blue Nile flow through Sudan, before joining in Khartoum to form the Nile proper, giving the country ample potential for irrigation. Abu Dhabi's project in north Sudan is being led by the Abu Dhabi Fund for Development, which has historically focused on providing poorer countries with soft loans for infrastructure projects.

Abu Dhabi is the largest of the seven emirates of the United Arab Emirates, which has a combined population of some 4m people.

Sudan - keen to attract funding and technology into agriculture - provided land free of charge to investors for such projects, officials said. Although rich in resources, it has been blighted by decades of misrule and conflict, and suffers from a dilapidated infrastructure and inefficient bureaucracy.

The Sudan scheme is the first of its kind for the Abu Dhabi fund and it will be working in partnership with the Arab Authority for Agricultural Investment and Development (AAAID), a pan-Arab agency based in Khartoum.

It was also considering projects in other countries including Senegal, with which it had had talks, and Uzbekistan, said Ahmed Abdulla Khamis al-Shamsi, the fund's deputy projects director.

Details of the Sudan scheme have not been finalised but the Abu Dhabi fund will look to produce corn, alfalfa (feed for livestock) and other crops, with wheat a possibility. A feasibility study on the project was due to be finished in four months, Mr Shamsi said. "Food security in Abu Dhabi, that is one of the main reasons."

The Abu Dhabi fund will be the main shareholder in a new company to run the project. It was in the process of setting up the entity with AAAID, Mr Shamsi said.

The fund is expected to invest several hundred million dirham in the scheme, although the final figure will not be known until the feasibility study is completed.

It was also considering other projects with the AAAID in Sudan, including research into the feasibility of growing rice and a livestock programme, officials said.

The AAAID was set up in 1977 as an independent financial agricultural investment institution and has paid up capital of about $367m (€237m, £187m), according to its website. Much of its work has been in Sudan. Gulf countries previously looked to invest in the country in the 1970s and 1980s, but those earlier projects failed.

Abdul-Rahim Hamdi, a former Sudanese finance minister who is close to the Khartoum regime, estimated that Sudan had about 100m acres of agricultural land, of which only 20m acres was being utilised. Most of that had only minimal productivity and relied on rain-fed irrigation, he said, adding that only 2m acres were being intensively farmed.

Sudan would welcome foreign investment in the sector to boost non-oil exports and improve the poor state of infrastructure.

"It needs a lot of funding and technology. We have manpower, we have a lot of very highly educated agriculturalists, but the problem is funding and technology. If there's agriculture investment some will go directly into the Sudanese market, but most of it will go into exports, at international prices presumably, so it will be very positive."

The Abu Dhabi fund - which has provided loans totalling about Dh12bn ($3.3bn, €2.1bn, £1.7bn) to more than 50 countries since it was set up in 1971 - has been able to leverage off a history of relations with Khartoum to move the project forward.

It has provided about $200m in soft loans to help finance the construction of the hydroelectric Merowe Dam, a vital but controversial project in Sudan.

Through its equity department, which will supervise the agriculture project, the fund also has a big shareholding in a company that owns presidential villas in Sudan.