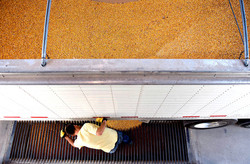

Canada’s new corn belt attracts hot money to bargain farmland

By Alan Bjerga

U.S. farmers in the Midwest, the center of corn cultivation in North America, have watched helplessly as the worst drought in more than five decades has devastated their crop.

Canadian farmers in the prairie provinces of Manitoba, Saskatchewan and Alberta, long one of the greatest wheat-growing regions on Earth, have started planting corn, Bloomberg Businessweek reports in its Nov. 12 issue. The corn zone for government crop-insurance coverage reaches to Dan Mazier’s farm near Justice, Manitoba -- about 60 miles (97 kilometers) north of the U.S. border -- and ends right along a road that divides his property.

“I told them the sun shines on both sides of the road, but they haven’t caught up to the weather yet,” said Mazier, who sowed the grain for the first time this year. “So I only plant it south of the line.”

Corn’s new appeal to Canada’s prairie farmers is based on two things: climate change and price. Growing seasons in the prairie provinces -- which border Minnesota, North Dakota and Montana -- have lengthened about two weeks to as long as 120 days in the past half-century. The mean annual temperature is likely to climb by as much as 3 degrees Celsius (5 degrees Fahrenheit) in the region by 2050, according to Canadian researchers.

A temperate climate and longer growing season are ideal for corn. An acre of farmland produces more corn than wheat, making corn the more profitable grain, while the higher yields also drive up land values. Corn has long grown in southern Ontario’s mild climate, but for Canadians to be big players in the crop at a new order of magnitude they must plant in the vast farmland of the prairie provinces. Farmers sowed a record 121,400 hectares (300,000 acres) of corn in Manitoba, Saskatchewan and Alberta this year. That compares with an estimated 96.9 million acres sown in the U.S.

Transformed Mix

Global corn demand has outstripped supplies three of the past four years. That shortfall, along with the more hospitable growing weather and the introduction of seed varieties from St. Louis-based Monsanto Co. and DuPont Co. that make plants mature faster, is transforming Canada’s grain mix, said Danny Blair, a professor of geography at the University of Winnipeg.

“The winters have warmed and shortened dramatically,” accompanied by more rainfall that allows for earlier planting and greater soil moisture that helps crops, he said.

Global warming will increase the frequency of drought and erratic rainfall even in Canada, said Blair, who noted that along with greater risk, the weather creates more opportunities for Canadian agriculture.

Anticipated Boom

The anticipated boom in corn is encouraging Cargill Inc., the Minneapolis-based agribusiness giant, to invest in grain storage in Canada, according to Chief Executive Officer Gregory Page. The prospect of new demand from Canadian corn farmers is pushing DuPont Pioneer, a seed division of Wilmington, Delaware- based DuPont, to improve its short-season crop varieties, said John Soper, the company’s vice president of crop-genetics research and development.

The prospect of a Canadian corn belt has helped push farmland values nationwide up 27 percent from 2007 to 2011, to C$1,610 ($1,616) an acre. U.S. farmland prices rose 19 percent in the same period to $2,390 an acre.

The northward creep of the corn belt is turning Canadian farmland into a long-term investment play on global warming, said Tom Eisenhauer, president of Ottawa-based Bonnefield Inc., a farmland investment firm that owns 15,000 acres across the country. “You can do a lot of different things here with a longer growing season,” he said.

Heightened Interest

“Every day I field calls from potential investors, from pension funds, from family businesses that want to buy” from inside and outside Canada, said Doug Emsley, president of Regina, Saskatchewan-based Assiniboia Capital Corp., the largest farmland investment company in the nation, with some 115,000 acres under management valued at about C$90 million. With Saskatchewan farmland selling for at least 18 percent less than in bordering Montana and North Dakota, the U.S. drought has heightened interest as the risks of too-warm weather weigh on buyers’ minds, he said.

Sticking Point

A major sticking point is the availability of the land to foreign investors. Ontario, British Columbia and other, smaller Canadian provinces have no restrictions on foreign ownership of farmland. The prairie provinces, though, keep individual foreign investors from owning any more than 10 to 40 acres. In Saskatchewan, where restrictions are the toughest, the idea is that land is a natural resource that should not be controlled by outsiders, said Mark Folk, general manager of the provincial Farm Land Security Board.

In some cases, said Folk, interest in Canadian land has spurred would-be buyers to establish Canadian residency. Unless these restrictions are loosened, Canadian farmland won’t reach its full investment potential, Emsley said. Outside Canada’s prairie, opportunities are easier and drawing attention, said Eisenhauer, who adds that, as in the U.S., the bulk of land sales are still made by farmers to each other, not to outside investors.

Corn farming is expanding north in Ontario. In northern British Columbia and Alberta, grains such as barley and oats are also thriving thanks to the increasing warmth. “You’re going to see more of it with climate change,” Eisenhauer said.

Mazier, the Manitoba farmer at the northern limit of the corn belt, said his options are expanding with the milder temperatures. “Our winter last year was beautiful. When you see that, and you see the prices, you have to try something a little bit newer.”

To contact the reporter on this story: Alan Bjerga in Washington at [email protected]

To contact the editor responsible for this story: Jon Morgan at [email protected]