Dow Jones Newswires | 14 Mar 2011

Angela Henshall

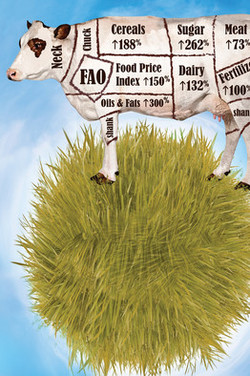

The recent spikes in the price of food, which have acted as a catalyst to protests across the developing world, are a short-term manifestation of a long-term trend: That of high and rising agricultural commodity prices. But getting investment exposure to this long-term upswing in prices, without falling foul of the inevitable short-term volatility, is a conundrum that is proving hard to unravel.

Against a backdrop of tightening supply, investors have started to think about agriculture and food-commodity stocks in the same way they once considered energy investments. Jim Rogers, co-founder of the Quantum Fund with George Soros, says the world is on a knife edge. "Some governments have started hoarding stocks which will drive up prices. But will be blaming it on speculators like me," he says.

Rogers, who is credited with predicting the start of the global commodities rally in 1999, believes a crisis point will be reached within the next 20 years but that the answer lies in boosting investment to the sector. "If I'm right, agriculture is going to be one of the greatest industries in the next 20 years and longer . . . [it] will become more profitable than it has ever been," he says.

The case for long-term investment is sound. The world's population is expected to grow from 6.7 billion today to 9.1 billion by 2050. To put that into perspective, an extra three mouths will need to be fed every second in 40 years time. The supply problem is compounded yet further by an emerging middle class in China and India whose growing wealth is being reflected in changing dietary habits. Predominantly grain-based diets are being replaced by meat-based diets.

This has huge implications on demand for soft commodities when you consider that it takes 10 kilos of plant protein to produce just one kilo of animal protein. In other words, it is many times more energy intensive to grow a field of cows than a field of barley or maize.

The rising popularity of biofuels as an alternative to fossil fuels is only adding to these supply pressures. More and more land is being taken out of agricultural production and set aside to grow plants that are used to fuel cars, and not to feed people.

Investment Potential

For those seeking exposure to the agriculture story in the short-to-medium term there are several products that follow commodity indices. These enable investors to gain exposure to commodities without trading futures or taking physical delivery. The indices themselves closely track spot and futures contracts of agricultural commodities. One of these is the ETFS Agriculture Fund, an exchange traded commodities product designed to track the DJ-UBS Agriculture Sub-Index.

Daniel Wills, senior analyst at ETF Securities, says crop failures in Russia in 2009 and 2010 highlighted the potential for short-to-medium term volatility. This sparked investor interest. In 2009, about $1bn flowed into the ETFS Agriculture fund but by the end of 2010, $500m had flowed out as investors booked their profits. Wills expects to see volatility increase and says that 2011 will be a year of depleted exports and stock levels in a number of countries.

"There's a lot of pressure on governments this year to rebuild the coffers, and it leaves the market vulnerable to price shocks," he says. Building of strategic stockpiles and hoarding goes to the very heart of food security. Soft commodities in particular are thought to be very vulnerable to price shocks this year.

Strategic reserves will become increasingly important as food inflation bites. China has already released some of its strategic stock pile of soybeans into the market, says Wills, who believes reserves will increasingly be used to smooth out price spikes in the future. Long-term demand drivers like population growth, changes in dietary habits and the emergence of the biofuels industry all underline a structural pick-up in demand across the board for agricultural products, says Moritz Baumann, a strategic analyst at Banque Julius Baer. "But we have to differentiate between getting exposure to the agriculture theme in the short-term versus the long-term. Short-term exposure can be implemented via investments in commodity futures," he says.

Equity Steaks

However, Baumann does not believe commodity futures are the right vehicles to access long-term structural themes. This is because futures only offer a limited time horizon -mostly up to two years - and are not easily tradable. Instead, Baumann believes in building up exposure to agricultural products via equity investments.

For medium-term investors there is a range of options for equity investment in industries directly linked to the agricultural sector. These include: Equipment manufacturers, seed and chemical fertilizers and commodity and agricultural producers. Investment managers tend to keep investments closely tied to the producers who will benefit directly from rising prices.

"To play this theme in the longer term, equity exposure in companies operating within the agricultural sector like fertilizers, crop protection and the seed industry is the most feasible method," Baumann says.

Cédric Lecamp, co-manager of the agriculture fund at Swiss private bank Pictet, says higher crop prices in China will translate into higher farm incomes. This leaves farmers in a better position to buy fertilizer, farm machinery and crop protection chemicals. As a result, all those companies that service the industry will reap the benefit. "We favor upstream exposure to the agriculture value chain, particularly in companies that have strong pricing power and offer yield enhancing benefits," Lecamp says.

For investors looking to make a long-term commitment to agriculture investment, private equity could offer the biggest rewards. UK-based asset management firm, Emergent Asset Management, is raising funds to secure food production from a wide range of soft commodities across sub-Saharan Africa.

The firm has joined forces with South African agricultural specialist, GrainVest, to buy agricultural land and managed projects in 14 countries in Africa. The joint venture, known as EmVest, selects large chunks of land that are considered to be prime regional locations for development. It then works with national and local authorities to develop large-scale agriculture on a commercial basis.

Many believe investment in farmland offers a good alternative to investing in futures contracts for soft commodities, where prices have already surged higher. Although values of farmland have risen globally, there is still a huge gap between land prices in Africa and the rest of the world. Statistics support the fact that the availability of agricultural land globally is diminishing. However, David Murrin, chief investment officer at Emergent Asset Management, stresses the difficulties of jumping aboard the African growth story. "It is very hard to take advantage of the tremendous growth in African agriculture and that's why private equity investment is so important, it helps capture some of that growth," he says.

With a minimum investment of €5m for institutional investors and €500,000 for retail investors this project is not for the light of wallet. Those that are able to invest, however, could be in line for big rewards.

Based on the four-year pilot project, estimated returns to investors could be up to 30% per annum over its five year term. Emergent is confident this performance can be achieved by using modern farming techniques and technologies to increase yields. Agglomerating farms will also increase efficiency and the capital value of the farmland itself is also expected to increase as a result of the development.

Write to Angela Henshall at [email protected].

Harvesting returns: investing in agriculture

- Tags: Emergent

-

Wall Street Journal

Wall Street Journal

- 14 Mar 2011

Who's involved?

Whos Involved?

Carbon land deals

Dataset on land deals for carbon plantations

07 Oct 2025 - Cape Town, South Africa

Land, Life and Society: International conference on the road to ICARRD+20

Languages

- Amharic

- Bahasa Indonesia

- Català

- Dansk

- Deutsch

- English

- Español

- français

- Italiano

- Kurdish

- Malagasy

- Nederlands

- Português

- Suomi

- Svenska

- Türkçe

- العربي

- 日本語