Agence France-Presse | July 20, 2008

DUBAI--Faced with a scarcity of fertile land, water shortages and surging world food prices, wealthy Arab states in the Gulf are seeking to secure their food supplies by investing in agriculture abroad.

Saudi Arabia and the United Arab Emirates, the top food importers among Arab countries in the Gulf, are now looking to Asia and Africa as opportunities for agricultural investments.

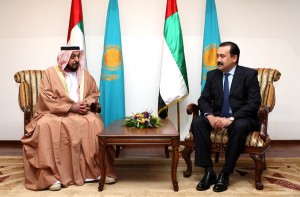

UAE President Sheikh Khalifa bin Zayed al-Nahayan said in Kazakhstan on Monday that his country, which imports around 85 percent of its food, is interested in the central Asian nation "to diversify its sources of food supplies."

Investing in agriculture abroad "is part of our strategic investment in general," UAE Economy Minister Sultan bin Said al-Mansuri said earlier this month.

Rapid growth fuelled by record oil revenues has triggered a huge influx of expatriates in the Gulf, steadily boosting populations and stretching the ability to meet demand for mostly imported foodstuffs.

The total population of the six members of the Gulf Cooperation Council -- Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE -- rose from around 30 million in 2000 to more than 35 million in 2006, according to GCC statistics.

This figure is expected to reach nearly 39 million by 2010 and 58 million by 2030, according to a Dubai-based Gulf Research Center (GRC) report.

Although these nations have huge oil reserves they are among the world's poorest in natural water resources and arable land -- just two percent of the vast Saudi desert kingdom and one percent of the UAE.

GCC food imports cost $10 billion in 2007, said the GRC study, although some press reports put the figure much higher. Saudi Arabia, with a population of about 24 million, remains the largest food importer.

Amid surging food prices and a fear of shortages caused by export bans from major crop-producing countries, GCC states now want food lifelines.

For Saudi Arabia investing in agriculture abroad marks a shift from its own costly crop self-sufficiency scheme.

"In the 1970s and 1980s Saudi Arabia developed its own agricultural sector for food security," said Monica Malik, economist at the Dubai-based EFG-Hermes investment bank.

"However the sector had to be highly subsidized by the government for it to be economically viable given the climatic conditions," she told AFP.

In a kingdom with scarce water reserves a ton of barley requires roughly 1,212 cubic meters (42,801 cubic feet) of practically exhausted ground-water reserves, the GRC said.

Malik said the issue of food security has worsened globally given the sharp rise in food prices and demand.

"A number of GCC countries are looking at establishing agricultural ventures in nearby countries such as Sudan for this food security and as a cheaper alternative to domestic production," she said.

"Proximity is important, as is a good relationship with the other country to secure food supplies," Malik added. Close ties with partner countries could protect the GCC against export bans in times of crop shortages in exporting countries, she said.

One reported UAE project to develop more than 70,000 acres (28,328 hectares) of arable land in Sudan is in line with this strategy. Riyadh has also held talks with Khartoum on agricultural projects, the Financial Times reported last month.

Africa's largest country has abundant water resources including the Nile River, the world's longest.

But Sudanese agriculture remains massively underdeveloped, although it employs 80 percent of the workforce, with much of the population reliant on subsistence agriculture.

Egypt and Pakistan have also been targeted by Saudi Arabia and the UAE for food projects. Both Muslim countries have large expatriate communities in the Gulf that send home huge amounts of money annually.

"There are some projects we are negotiating with the UAE related to food security for the UAE," Egypt's foreign trade and industry minister, Rashid Mohammed Rashid, was quoted by the Emirati daily The National as saying this month.

In Pakistan, the UAE is considering buying more than 100,000 acres (40,470 hectares) of farmland worth $500 million, press reports said. Private UAE firms such as the Dubai-based Abraaj Capital have also reportedly been buying agricultural land in Pakistan.

According to the reports, when Pakistani Prime Minister Yousuf Raza Gilani visited Saudi Arabia in June he offered hundreds of thousands of acres of agricultural land to the Saudis in return for oil.

But agricultural exporters including Egypt and Pakistan recently imposed export bans on certain crops after riots triggered by food shortages at home.

Host countries for agricultural investment may therefore be unable to allow exports because they have to feed their own people.

One issue reportedly delaying UAE investment in Pakistan is the Gulf state appearing to want "blanket exemption" from Islamabad's agricultural export policies, according to a Pakistani official cited by The National.