Swedwatch | Press Release 2013-04-16

New report on the Second Swedish National Pension Fund's, AP2’s, investments in Brazil:

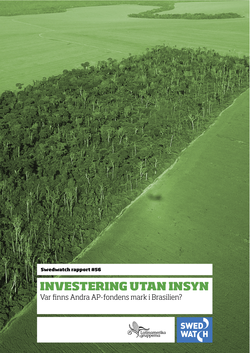

Lack of transparency when Swedish Pension Fund AP2 invests in farmland in Brazil

A new Swedwatch report shows a lack of transparency and inadequate auditing of ethics and environmental impacts in AP2’s investment in farmland in Brazil. For business reasons, the investment is surrounded by a high level of secrecy, which makes scrutiny from the outside impossible.

In 2011, AP2 formed a company, TIAA-CREF Global Agriculture, together with the American pension fund TIAA-CREF in order to buy agricultural land in the U.S., Australia and Brazil. $450 million have been allocated to the company by AP2, of which $180 million have been invested to date. AP2's investment in agricultural land is part of a global trend in which an increasing demand for food, biofuels and fodder has made land an attractive investment for several actors, among them pension funds, companies, banks and governments.

In Brazil TIAA-CREF Global Agriculture has acquired 60 000 hectares of land, divided into eleven farms, in four Brazilian states, namely São Paolo, Mato Grosso, Maranhão and Piauí. AP2 and the other investors do not conduct any regular or detailed auditing of environmental and social aspects on the farms they have acquired. Swedwatch also concludes that there is a serious lack of transparency surrounding the investment.

- AP2 has chosen not to disclose information about the location of the acquired land. This has made it impossible for Swedwatch to undertake field studies in Brazil and examine whether AP2's land investments follow international guidelines on ethics and the environment, says Malena Wahlin, researcher at Swedwatch and author of the report.

The investment is managed by the Brazilian company Radar Propriedades Agricola which leases the farmland to large Brazilian companies such as Raizen, SLC Agricola, AgriInvest and Vanguarda growing soy, sugarcane, cotton and corn on the land. Common problems within these farming sectors are high use of pesticides, poor working conditions and reduced biodiversity. Radar’s parent companies Cosan and Raizén, have been involved in violations of workers' and indigenous peoples' rights through their subcontractors.

- It is not possible to guarantee that our joint pension funds do not contribute to human rights violations or environmental degradation unless the transparency increases, says Francisco Contreras, president of Latinamerikagrupperna.

► Download the report (in Swedish) at http://www.swedwatch.org/sv/rapporter/investering-utan-insyn

► Summary (in English): http://farmlandgrab.org/uploads/attachment/Summary (ENG).pdf

For more information contact:

Malena Wahlin, researcher, Swedwatch, tel +46 8 602 89 85

Annelie Andersson, campaign and PR manager, Latinamerikagrupperna, tel +46 73 903 10 17

Francisco Contreras, chair, Latinamerikargupperna, tel +46 70 795 38 42