Oman - A pat for the private sector

- Times of Oman

- 14 September 2009

Oman has decided to appoint a specialist company to prepare the Sultanate's national strategy for food security.

Oman has decided to appoint a specialist company to prepare the Sultanate's national strategy for food security.

American drone attacks against the Taliban are routinely condemned in Pakistan as violations of national sovereignty. But there is little criticism of how our own government is threatening the country's territorial integrity by engineering the lease of millions of acres to foreign investors.

Philippine President Arroyo will meet with Saudi Minister of Agriculture Fahd Bin Abdulrahman Balghunaim to discuss bilateral agricultural projects and with members of the Saudi business community for talks on proposals for investments in the Philippines.

There are better means to meet the food needs of the Saudis than to lease thm land that belongs to the state and the people of Pakistan

What started as a government drive to secure cheap food resource has now become a viable business model and many Gulf companies are venturing into agricultural investments to diversify their portfolios.

Nazar Gondal said that government of Saudi Arabia has shown interest to acquire some land in Pakistan for farming but there was no progress in this regard so far.

Foreign Minister Makhdoom Shah Mahmood Qureshi said that the government has so far not requested for any input from the Foreign Office regarding interest shown by foreign parties to lease Pakistani land for agriculture. “But if my ministry is asked for its input, then I would not oppose this move completely."

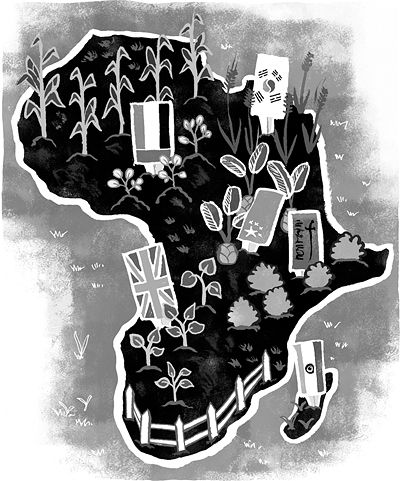

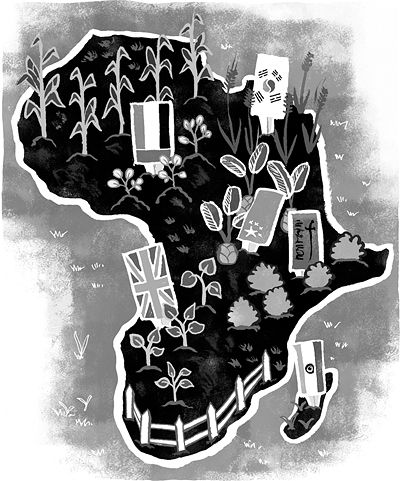

The United Nations Food and Agriculture Organisation (FAO), alarmed at the way governments and private corporations are buying farmland in developing countries, plans to present international guidelines to protect local people and farmers from what some have dubbed "neo-colonialism".

Whilst Mali’s government declares its commitment to guaranteeing food self-sufficiency for the country, it continues to sign a worrying number of agreements with foreign investors. A report from Via Campesina.

The problem is that we will lose control. Of course, some regulatory framework will be put in place, but it will also include ceding of control over our land resource to foreigners for a yet-to-be-specified time period.

A conference to discuss ways of boosting agricultural production in Africa will be held in Zanzibar later this month

Putin's latest land reform legislation could lead to over 400mn hectares of crop acreage being sold.