Spotlight on "land grab" deals

- IRIN

- 14 November 2012

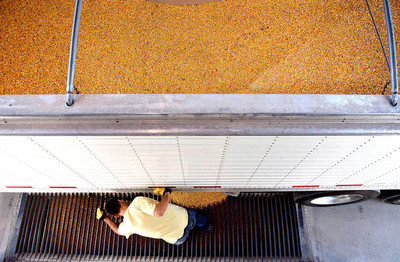

A new study puts "land-grab" deals into the context of agricultural investments more generally.

A new study puts "land-grab" deals into the context of agricultural investments more generally.

Carlyle is part of a small group of investors that will inject $210 million into Export Trading Group, a Tanzania-based agricultural company that controls at least 60,000 hectares of farmland in Africa.

Louis Dreyfus lifted the lid on commodities operations such as its 45 orange groves, and unveiled a healthy appetite for investment, as, after 160 years, it unveiled its first public results statement.

New FAO report focuses on investments in developing countries, urging caution on large-scale land acquisitions

Report by Deutsche Bank examines the global rush for land

Duxton Asset Management has bought more than 800 hectares of Australian fruit orchards for a discount of more than 50 per cent from receivers of failed managed investment scheme Rewards Group and listed land owner Ark Fund.

With the ups and downs of the stock market in the past few years and the boom in the rural economy, institutional investors are looking at farmland as a tangible, stable asset to have in their portfolio.

Could a recent farm workers dispute in, De Doorns, a wine region in the Western Cape in South Africa, become the agriculture equivalent of the Lonmin's platinum mine dispute?

New research indicates that foreign ownership of farmland and other rural real estate in New Zealand may be closer to 10%, significantly higher than a recent conflicting estimate of 1.5%.

A heated debate ensued yesterday in Tanzania's Parliament after Kawe lawmaker Halima Mdee moved a private motion calling on the House to adopt a resolution pressing the government to suspend the allocation of huge chunks of land for investment to foreigners.

Chinese land grabs in Africa are a media myth, according to regional expert Professor Deborah Brautigam.

“Every day I field calls from potential investors, from pension funds, from family businesses that want to buy” from inside and outside Canada, said Doug Emsley, president of Assiniboia Capital Corp.