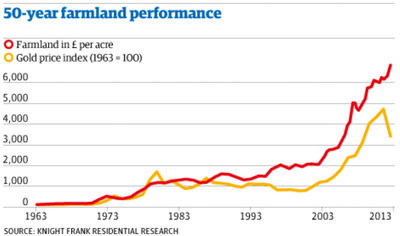

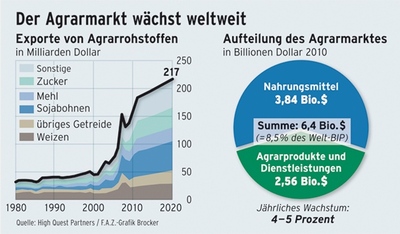

Investors, hedge funds flock around opportunities in agriculture

- Opalesque

- 07 October 2014

"The buzz has actually been agricultural investment conferences, where about one tenth of the people seem to be people I recognize from the hedge fund circuit."