Así es cómo se venden las islas, un ejemplo claro y concreto

- La casa de mi tía

- 12 June 2025

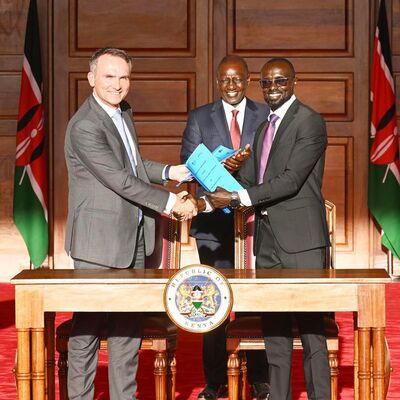

Canarias negocia un acuerdo con la multinacional emiratí Al Dahra Agricultural Company, que según organizaciones "Se trata de un modelo que entrega tierras y agua, escasas y disputadas en un archipélago que ya depende de 90% de importaciones"