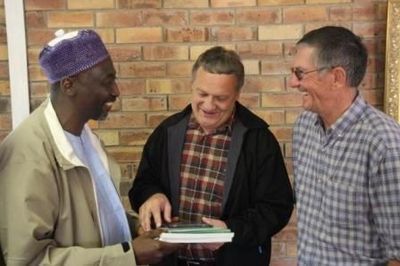

Sierra Leone Environment Protection Agency investigates Addax environmental activities in Makeni communities

- Standard Times

- 28 June 2011

Full force delegation headed by the EPA Executive Chairperson, Madam Haddijatou Jallow, visited the Addax operational areas and got first hand information from the community people.