CBK seeks answers about Karuturi saga

- The Standard

- 22 November 2018

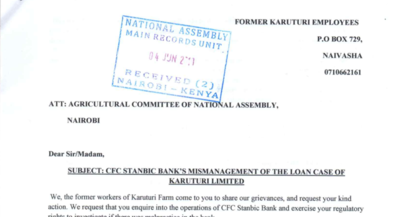

CFC Stanbic bank has been asked to explain a debt it is owed by struggling Naivasha-based Karuturi flower farm.

CFC Stanbic bank has been asked to explain a debt it is owed by struggling Naivasha-based Karuturi flower farm.

The Governor of Meru, Kenya has promised Chinese investors free land as he seeks to attract investment in agribusiness and the hospitality industry.

A report by the Economist Intelligence Unit says land grabs are another common mechanism of corruption threatening Kenya's food security, citing instances where backdoor deals were used to secure land.

Kenya's Court of Appeal is in December expected to determine if Karuturi will pay Sh1.8 billion contested debt to Stanbic Bank before the dispute before High Court is determined.

Siaya county government has not surrendered the Yala swamp to a private sugar milling company as alleged by a section of the media, the county director of communications, Jerry Ochieng has said.

Kenya's court of appeal will rule on the 20th of December on the ownership of the Karuturi farm which was put under receivership over a debt it owed one of the banks.

As announced as part of Prime Minister Theresa May's visit to Africa, the Department for International Development will provide a further £55m to support AgDevCo's mission to create jobs, improve food security and boost prosperity in Africa.

L’étude porte principalement sur deux pays, le Kenya et l’Ethiopie

Naivasha-based flower firm Karuturi has sued Stanbic Bank and four receiver managers for allegedly thwarting its revival through mismanagement and secret acquisition of loans.

The employees accuse CFC Stanbic of demanding more money than it lent to Karuturi, saying the South African lender is responsible for the poverty that struck their families since Karuturi was placed under receivership, 3 years ago.

The lives of more than 3,000 people came to a standstill when the Karuturi flower farm shut its doors in May 2015 after being placed under receivership over accrued debt.

In a paid advert, the receiver managers detailed the items for sale but also indicated that the close to 125 hectares where the company sits would not be sold.