UN casts eye on GCC's farmland investment

- Bahrain Tribune

- 07 September 2010

Abu Dhabi finalises scheme to purchase 29,400 hectares of land in Sudan

Abu Dhabi finalises scheme to purchase 29,400 hectares of land in Sudan

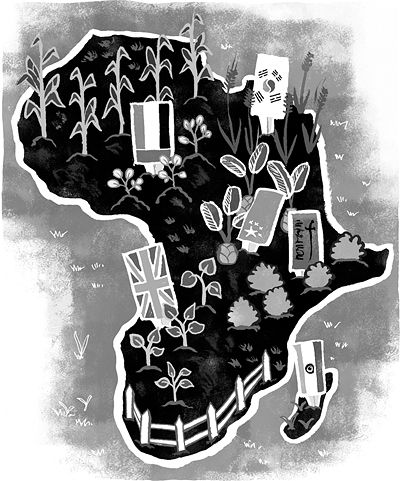

Between 2007 and mid-2008, Gulf states and their government-backed businesses spent US$15 billion (Dh55bn) in sub-Saharan Africa alone, much of it in the drive for food security

The UAE has embarked on an overseas investment spree to ensure domestic food security in a country with miniscule arable area -- a spree that will only grow

Why produce a low-value crop such as wheat using expensive water when the FAO says the global wheat harvest will this year be second only to last year’s record?

Emirates International Investment Company is currently in negotiations with Algerian authorities for the purchase of land to build a large-scale milk farm, Mahassil.

What started as a government drive to secure cheap food resource has now become a viable business model and many Gulf companies are venturing into agricultural investments to diversify their portfolios.

Pakistan dramatically increased the amount of farmland open to foreign investors to six million acres, but will require outsiders to share half of their crop with local growers, Pakistan’s investment minister told Reuters.

THESE days, as we follow the struggle against the Taliban in the northwest, we can be forgiven for missing other important news. For instance, I had filed away a report on plans to lease large chunks of agricultural land in Punjab and Sindh to overseas investors in the back of my mind, planning to write about it later. When I ran a Google search on the subject, however, I realised the enormity of the scam.When I ran a Google search

Essentially, the Middle East is left with two choices. “The region has to import. The question is, invest abroad or rely on the free market?” said Dr Eckart Woertz, program manager in economics at the Gulf Research Center in Dubai.

The UN’s food security expert, Olivier de Schutter, has called for a “code of conduct” to regulate the purchase of swathes of farmland across Africa, Asia and Latin America by Gulf states and private companies pursuing agribusiness.

A conference for fund managers tied to agriculture held annually in Sydney by Austock, an Australian broker, attracted a few dozen contrarian souls three years ago. This year’s event, which began on March 16th, had to be restricted to several hundred ticket-holders, with many others turned away.

With vast tracts of land being sold in Madagascar, and Sudan and other African governments actively seeking investors in agricultural land, are we witnessing a neo-colonial land grab or will the investment result in greater food productivity to the long-term benefit of recipient nations?

|

KKR acquires ProTen from Aware Super

|