GRAIN | 13 November 2018

The global farmland grab by pension funds needs to stop

Money from pension funds has fuelled the financial sector's massive move into farmland investing over the past decade. The number of pension funds involved in farmland investment and the amount of money they are deploying into it is increasing, under the radar. This unprecedented take-over of farmland by financial companies has major implications for rural communities and food systems, and must be challenged. Leaving it to the companies to police themselves with their own voluntary guidelines is a recipe for disaster.

Download the PDF report at: https://www.grain.org/e/6059

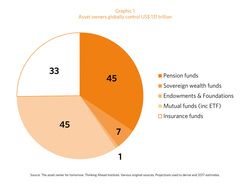

Back in 2011, at the height of the scramble for farmland around the world, GRAIN released a report on pension funds.1 We wanted to highlight the involvement of pension funds in this rush for farmland, not only because they were one of the main sources of funding for companies acquiring large areas of farmland but also because of the opportunities they provide for action. Pension fund managers, who handle massive amounts of money (see Graphic 1)2, are supposed to be accountable to the workers whose retirement savings they manage, making them, we hoped, more susceptible to social pressure than other farmland grabbers.

Much has happened over the past seven years. As we discussed in another report last year, the pace of the global farmland grab has slowed. Community resistance, bad press and investor incompetence have all played a role in reducing the scope and number of large-scale farmland deals in most parts of the world.3 But the phenomenon has not gone away, and, unfortunately, within the financial sector, farmland has become an "alternative" option for managers looking for diversification and new income streams. Pension funds, more than any other financial actor, are responsible for making this happen. Without cash injections from pension fund managers, most of the farmland funds in operation today would not have survived or come into existence.

Farmland's allure for pension funds

There is, to our knowledge, no comprehensive database of pension fund investment in farmland. We combed through the available public documentation and relevant journals to try and piece together as complete a picture as we possibly could (see Table 1)4. We identified 76 public and corporate pension funds with investments in farmland, managed either in-house or by external fund managers.5 We estimate that these pension funds had allocated roughly US$14.8 billion to farmland investments by August 2018.

This total sits at the top of the range we estimated back in 2011 and it compares with those of other industry sources. The financial analyst company, Preqin, produced a study in 2016 in which it identified 100 unlisted "agriculture/farmland-focused funds" that had closed since 2006, raising approximately US$ 22 billion.6 Farmland funds are typically managed by a financial company which pools the money of different investors to acquire farmlands and then manage the farms on their behalf, either by leasing the lands out to farmers or hiring farm management companies. In some cases, the farmland fund manager may own the company running the farms. Preqin found that the largest proportion of investors in these farmland funds were pension funds, both public pension funds (20%) and private (12%). Our data would suggest that the weight of pension funds in overall farmland investment is much higher.

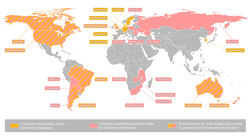

Our data also provide some important revelations about geography (see map). On the one hand, most of the money going into farmland is coming from North American and European pension funds, with the pension funds from the United States (US) outpacing those of any other country. This is partly a reflection of the overall size of US pension funds, which account for nearly half of all assets held by the world's pension funds.7 US pension funds are also more involved in so-called "alternative investments" than pension funds in other parts of the world, and natural resources (i.e timberlands and farmlands) are now common components of an alternatives portfolio.8

But European pension funds are also shifting to alternatives, largely as a solution to low-yielding bonds, as are big pension funds from other parts of the world, including China, South Korea, Malaysia, Australia and New Zealand.9 Chile just removed regulations that had previously blocked its sizeable state pension funds from investing in alternatives.10 South Africa's state pension funds made a major move into agribusiness this October, when the funds teamed up with a black-economic empowerment financial group to buy out Africa's biggest cattle feedlot and abattoir.11 In June 2018, the Japanese government gave the Government Pension Investment Fund, the world’s biggest pool of pension money, authorisation to participate in limited partnership schemes for alternative assets, which gives it much greater potential to invest in alternatives, including farmland.12 In April 2018, in what could be the start of a trend among Japanese financial companies, Nippon Life Insurance became the first Japanese company to make a sizeable investment in an overseas farmland fund.13

The other conclusion to draw about geography relates to where pension funds are acquiring farmland. They have confined their farmland acquisitions to North America, Europe, Australia, New Zealand and parts of South America where there are functioning land markets and sufficient infrastructure for commodity exports. Pension funds are more averse to investing in Africa and other places where lands are less privatised, the infrastructure is less developed and they are more liable to accusations of land grabbing.14 In those parts of the world, most large-scale land deals are being carried out by agribusiness companies, often with financing from development banks and support from their home governments.15

But there is clearly a spectrum of risk pension funds are prepared to take. Brazil, for example, is a major target for pension fund farmland acquisitions, yet it ranks highest in the world for land conflicts resulting from agribusiness.16 Eastern European farmland is another important target for pension fund managers, even though the land markets there are notoriously corrupt and riddled with fraud, and some pension funds have already been caught in scandals.17

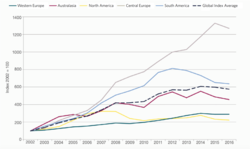

What attracts pension funds to these places, and what will continue to attract them there, is the potential for profits. In these frontiers for agribusiness expansion, where peasants and indigenous peoples are being displaced to make way for plantations, lots of money can be made speculating on land prices (see Graphic 218). So, while most pension funds are currently favouring farmland investments in their own countries, it appears that many view this as a trial run for farmland investments overseas, where bigger profits can eventually be reaped.

People should pay heed to this. The number of pension funds involved in farmland investment and the amount of money they are deploying into it is increasing, under the radar. Pension funds, both foreign and domestic, have quietly taken over huge swaths of farmland in the US, Australia and other industrial countries, without much pushback, even though the implications for rural communities are significant. We estimate that the amount of money pensions funds are currently putting into US farmland is enough to buy roughly 1 in 10 of the farms expected to come on the market in the US over the next five years.19 Combine this with the purchases of farmland that other financial companies and wealthy individuals like Bill Gates are making and the fact that a huge number of farmers in these countries are in their old age without plans to transfer their farms to their children, and the stage is set for a massive transfer of land from small farmers to financial corporations-- in the near total absence of public debate and regulation.

More work is urgently needed to expose the impacts pension fund investment in farmland is having in the US and other industrial countries. Not only because of how it affects rural communities in these countries, but also because, if these investments are not challenged, pension funds will be emboldened to make riskier farmland purchases overseas.

Pulling the plug on pension fund investment in farmland

Pension funds are susceptible to bad publicity. We have seen this concretely in the work we and others have done on this issue over the past years.20 The problem however is that pension funds have, by and large, responded by by ramping up their public relations efforts about their responsible investment practices - even when confronted with clear evidence that they are not even following their own guidelines. They have not, with only one exception that we know of, pulled their money out of their farmland deals.21

Some pension fund managers are too invested in global farmland to expect that they will pull out. TIAA, the "largest global farmland investor", has built a mini-empire of farms around the world, with cash supplied by numerous pension funds from different countries and from different sectors (from civil servants to doctors). Its public response to clear evidence that it was contributing to environmental destruction and land grabs in Brazil was to deny it, and then add a few extra pages to its responsible farmland investment report the following year.

The exposure and on-going pressure, including from its pension fund holder clients22, has most likely made it more difficult for TIAA to raise funds for its global farmland funds, and it is noticeable that it seems to have put a pause on investments in the northeast of Brazil, where its connections to land grabbing were exposed. It has also ceded to demands that it, at the very least, publish information about the location of its farmland holdings by creating a "Farmland map" for its properties.23 This was a useful achievement; it makes it possible for groups to keep exposing the issues with TIAA's claims about its responsible farmland investments and to show how such financial investment in farmland is detrimental.

The Harvard University endowment fund is another big farmland player, second only to TIAA in the scale and geographic spread of its farmland holdings. Harvard, however, managed all of its farmland deals internally and the managers who orchestrated most of the deals have left the company (only to form a new company that is now drawing in pension fund money for farmland and timber acquisitions in Latin America!).24 This increases the likelihood that Harvard could exit entirely from farmland if pressure is sustained, not least because of its embarrassment over the financial losses that many of its farmland deals seem to have generated.

Most pension funds are still sitting on the fence about farmland investment or timidly testing the waters. And the scandals engulfing two of the pioneer financial investors in global farmland, TIAA and Harvard, are, hopefully, contributing to their hesitations.

But this is not a matter that should be left to the board rooms of pension fund managers. The social consequences of the ongoing farmland grab by the financial sector are profound, and should be a subject of public debate. In many parts of the world, previous generations of farmers fought for laws and regulations preventing pension funds and other corporations from buying farmland, at the national, state, provincial or local level. We must urgently revitalise these struggles in the face of today's unprecedented take-over of farmland by corporate actors and financial speculators. Leaving it to these companies to police themselves with voluntary guidelines is a recipe for disaster.

It is also time to ask some deeper questions about how pensions, or perhaps more accurately, deferred wages, are organised. Pensions were a hard fought for victory for labour movements in some parts of the world, but they have also played a dual role by supporting the growth and power of global finance, which has been hugely destructive to working people.25 Moreover, the percentage of workers with real pension security these days is small and getting smaller. We are thus at an important moment to rethink and bring together two strands of activism: the struggles for social policies that can ensure adequate financial security for all elderly people and the struggles for savings systems that make social investments in the interests of working people everywhere (including farmers).

1 GRAIN, “Pension funds: key players in the global farmland grab,” 20 June 2011: https://www.grain.org/article/entries/4287-pension-funds-key-players-in-the-global-farmland-grab

2 Thinking Ahead Institute, "Global pension assets study 2018," February 2018: https://www.willistowerswatson.com/-/media/WTW/Images/Press/2018/01/Global-Pension-Asset-Study-2018-Japan.pdf

3 GRAIN, "The global farmland grab in 2016: how big, how bad?", 14 June 2016: https://www.grain.org/article/entries/5492-the-global-farmland-grab-in-2016-how-big-how-bad

4 Table 1: Pension funds with farmland investments (updated to August 2018), available at: https://goo.gl/R1S3ya

5 We did not include equity investments in agribusiness companies, such as oil palm plantation companies, unless the company was specifically set up to profit from rising farmland values, such as Black Earth Farming Ltd.

6 Preqin, "Special report on agriculture," September 2016: http://docs.preqin.com/reports/Preqin-Special-Report-Agriculture-September-2016.pdf

7 OECD, "Pension Funds in Figures," June 2018: https://www.oecd.org/daf/fin/private-pensions/Pension-Funds-in-Figures-2018.pdf

8 The Pew Charitable Trusts, "State Public Pension Funds Increase Use of Complex Investments," April 2017: https://www.pewtrusts.org/~/media/assets/2017/04/psrs_state_public_pension_funds_increase_use_of_complex_investments.pdf

9 See Theo Andrew, "UK pension funds expected to wade into alternatives," Pensions Age, 14 June 2018: http://www.pensionsage.com/pa/UK-pension-funds-expected-to-wade-into-alternatives.php; IP&E, "Korea’s major public funds are marching in," May 2012: https://www.ipe.com/countries/asia/koreas-major-public-funds-are-marching-in/www.ipe.com/countries/asia/koreas-major-public-funds-are-marching-in/10003627.fullarticle; Asia Asset Management, “Malaysia pension funds grow their alternative assets”, 12 June 2018: https://www.asiaasset.com/news/EPFKWAPAL_gte_0611.aspx; and OECD, "Pension Funds in Figures," June 2018: https://www.oecd.org/daf/fin/private-pensions/Pension-Funds-in-Figures-2018.pdf

10 Daniela Sirtori-Cortina, "AFP Capital readies to be first Chilean pension to access alts," Citywire Americas, 5 June 2018: https://citywireamericas.com/news/afp-capital-readies-to-be-first-chilean-pension-to-access-alts/a1126075

11 Hilton Shone and Loni Prinsloo, "PIC buys into Africa's biggest feedlot in $365 million deal, "Bloomberg, 23 October 2018: https://www.bloomberg.com/news/articles/2018-10-23/south-africa-s-pic-pelo-buy-majority-stake-in-karan-beef

12 Florence Chong, "Japan's GPIF given green light to invest in limited partnerships," IP&E, 25 June 2018: https://realassets.ipe.com/news/japans-gpif-given-green-light-to-invest-in-limited-partnerships/realassets.ipe.com/news/japans-gpif-given-green-light-to-invest-in-limited-partnerships/10025342.fullarticle

13 Global AgInvesting, "Japan's Nippon Life makes a US$92.5 million offshore farmland investment" 16 April 2018: http://www.globalaginvesting.com/japans-nippon-life-makes-us92-5m-offshore-farmland-investment/

14 Jonathan Williams, "Land-grabbing claims complicate agricultural investment, says BT scheme", IP&E, 9 March 2012: https://www.ipe.com/land-grabbing-claims-complicate-agricultural-investment-says-bt-scheme/www.ipe.com/land-grabbing-claims-complicate-agricultural-investment-says-bt-scheme/44360.fullarticle

15 GRAIN, "The global farmland grab in 2016: how big, how bad?", 14 June 2016: https://www.grain.org/article/entries/5492-the-global-farmland-grab-in-2016-how-big-how-bad

16 Jonathan Watts, "Almost four environmental defenders a week killed in 2017," Guardian, 2 February 2018: https://www.theguardian.com/environment/2018/feb/02/almost-four-environmental-defenders-a-week-killed-in-2017

17 "Dutch bank faces questions on Romania land-grab," EU Observer, 6 November 2015: https://euobserver.com/investigations/130989

18 Savills, "Global farmland value index", June 2016

19 Calculation is based on GRAIN's estimated total of $5 billion in committed investment from pension funds in US farmland, USDA ERS calculated average US farmland values from 2016 and USDA ERS estimates of the total value of farmland transactions expected from 2015-2019. See: USDA/ERS, "Land Acquisition and Transfer in U.S. Agriculture," August 2016: https://www.ers.usda.gov/amber-waves/2016/august/land-acquisition-and-transfer-in-us-agriculture/

20 For example, see: Jonathan Williams, "Land-grabbing claims complicate agricultural investment, says BT scheme", IP&E, 9 March 2012: https://www.ipe.com/land-grabbing-claims-complicate-agricultural-investment-says-bt-scheme/www.ipe.com/land-grabbing-claims-complicate-agricultural-investment-says-bt-scheme/44360.fullarticle

21 Reuters, "Canada's CPPIB pension fund plans farmland retreat," 26 April 2017: https://ca.reuters.com/article/businessNews/idCAKBN17S2JX-OCABS

22 Sheeraz Raza, "TIAA Clients And Activists To Deliver 100,000 Petitions To Pension Fund In NYC," Value Walk, 20 April 2017: https://www.valuewalk.com/2017/04/tiaa-farmland-protests/

24 For more on Harvard's farmland deals see: GRAIN and Rede Social de Justiça e Direitos Humanos, "Harvard's billion-dollar farmland fiasco," 6 September 2018: https://www.grain.org/article/entries/6006-harvard-s-billion-dollar-farmland-fiasco. The new company formed by Harvard's ex-farmland investment managers is Folium Capital, which has received investments from the New Mexico Educational Retirement Board. See: Real Assets, "New Mexico Educational invests in Folium and Stonepeak funds," August 2017: https://realassets.ipe.com/news/investors/new-mexico-educational-invests-in-folium-and-stonepeak-funds/realassets.ipe.com/news/investors/new-mexico-educational-invests-in-folium-and-stonepeak-funds/10020384.fullarticle

25 For a good discussion of whether workers and their organizations can exert meaningful control over pension funds in the context of current financial markets and a discussion of alternatives see: Kevin Skerrett, Chris Roberts, Johanna Weststar and Simon Archer, The Contradictions of Pension Fund Capitalism, Cornell University Press, 2017.