REDD-Monitor | 17th February 2012

How Norway and the Merauke Integrated Food and Energy Estate threaten peatland and forest in Papua

By Chris Lang

A new report by Greenomics Indonesia documents how the Merauke Integrated Food and Energy Estate threatens peatland and forest in Papua province, Indonesia. The moratorium on new forest concessions, part of the US$1 billion Indonesia-Norway REDD deal has no effect whatsoever in limiting the destruction.

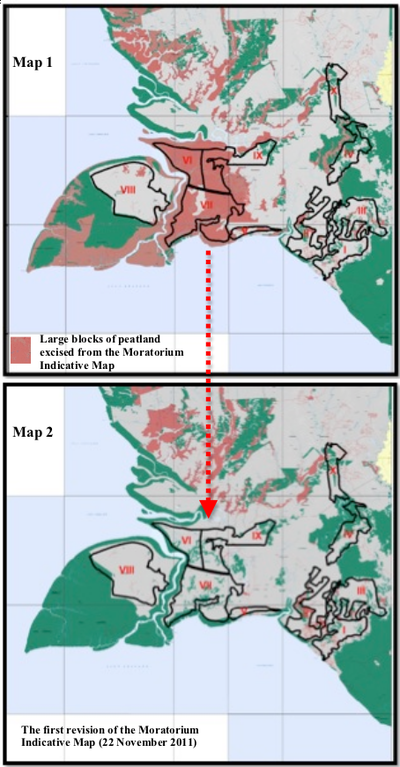

Greenomics Indonesia’s report reveals that 400,000 hectares of land, including 350,000 hectares of peatland have been removed from the Moratorium Indicative Map when it was revised on 22 November 2011. More than 200,000 hectares of primary forests remain under threat from MIFEE’s oil palm plantations.

The report, “Peatland and forest at serious risk from Merauke food and energy estate development”, can be downloaded here (pdf file, 669 kB).

Greenomics Indonesia’s report compares the Moratorium Indicative map issued on 17 June 2011 with the revision issued on 22 November 2011. The maps clearly show the overlap of MIFEE concessions with peatland or primary forest. In total, Greenomics Indonesia calculates that 406,718 hectares originally included in the moratorium were excised from the revised version of the Moratorium Indicative Map:

The two-year moratorium was introduced in May 2011, several months after the deadline agreed between Norway and Indonesia. During the discussions about the moratorium, several loopholes were inserted, one of which excludes rice and sugar cane concessions.

Clusters VI, VII and IX illustrated on the map above are partly allocated for rice cultivation. But some of the land in these clusters is allocated for livestock production, and growing corn and sago. These land-uses are not excluded from the moratorium.

In total there are 10 MIFEE clusters (or concession areas) covering an area of 1.2 million hectares. More than 200,000 hectares of primary forest are within the MIFEE concession areas. Greenomics Indonesia looks at two MIFEE clusters (IV and X) that are allocated for oil palm concessions. An area of 63,487 hectares of primary forest is indicated on the moratorium maps as primary forest within these two concessions. Greenomics Indonesia points out that,

REDD-Monitor is offering no prizes for guessing which country’s sovereign wealth fund owns shares in both Medco Energi International and LG International. Step forward the Norwegian Government Pension Fund Global.

In a presentation last week in a meeting about illegal logging at Chatham House in London, Jago Wadley, Senior Forest Campaigner at Environmental Investigation Agency, highlighted the hypocrisy of the Norwegian government’s claims to be reducing deforestation while at the same time investing in forest destroying companies. His presentation, titled “Norwegian Woods: Exploring Norway’s Contradictory Financial Incentives in South East Asia’s Land Use Sector”, can be downloaded here (pdf file, 2.2 MB).

In his presentation Wadley quotes Norway’s prime minister, Jen Stoltenberg as saying, “In today’s global markets, forests are worth more dead than alive.” Stoltenberg said this in 2010, at the Oslo Climate and Forest Conference, that saw the signing of the Letter of Intent between Norway and Indonesia. Stoltenberg continued by saying, “Today we commit to change that equation. It must pay off not to cut a tree, but leave it standing.”

Almost two years later, Norway is cynically proving that Stoltenberg’s first statement remains true and that Norway actually committed to nothing. Wadley looks at the Norwegian Government Pension Fund Global’s (GPFG) profits during 2010 from 29 companies in Indonesia and Southeast Asia that are involved in forest destruction. In December 2009, the value of GPFG’s investment was US$437 million. By December 2010, the figure had increased to US$678 million – as a result of US$96 million new investment and an increase of US$145 million profit. During the same period, Norway handed over US$30 million to Indonesia under the two country’s big REDD deal.

In other words, profits from Norway’s investments in forest destruction were almost five times as high as the payment aimed at reducing deforestation. By 2014, GPFG profits from plantation companies in Southeast Asia could amount to more than US$1.5 billion. As Wadley points out,

How Norway and the Merauke Integrated Food and Energy Estate threaten peatland and forest in Papua

By Chris Lang

A new report by Greenomics Indonesia documents how the Merauke Integrated Food and Energy Estate threatens peatland and forest in Papua province, Indonesia. The moratorium on new forest concessions, part of the US$1 billion Indonesia-Norway REDD deal has no effect whatsoever in limiting the destruction.

Greenomics Indonesia’s report reveals that 400,000 hectares of land, including 350,000 hectares of peatland have been removed from the Moratorium Indicative Map when it was revised on 22 November 2011. More than 200,000 hectares of primary forests remain under threat from MIFEE’s oil palm plantations.

The report, “Peatland and forest at serious risk from Merauke food and energy estate development”, can be downloaded here (pdf file, 669 kB).

Greenomics Indonesia’s report compares the Moratorium Indicative map issued on 17 June 2011 with the revision issued on 22 November 2011. The maps clearly show the overlap of MIFEE concessions with peatland or primary forest. In total, Greenomics Indonesia calculates that 406,718 hectares originally included in the moratorium were excised from the revised version of the Moratorium Indicative Map:

The two-year moratorium was introduced in May 2011, several months after the deadline agreed between Norway and Indonesia. During the discussions about the moratorium, several loopholes were inserted, one of which excludes rice and sugar cane concessions.

Clusters VI, VII and IX illustrated on the map above are partly allocated for rice cultivation. But some of the land in these clusters is allocated for livestock production, and growing corn and sago. These land-uses are not excluded from the moratorium.

In total there are 10 MIFEE clusters (or concession areas) covering an area of 1.2 million hectares. More than 200,000 hectares of primary forest are within the MIFEE concession areas. Greenomics Indonesia looks at two MIFEE clusters (IV and X) that are allocated for oil palm concessions. An area of 63,487 hectares of primary forest is indicated on the moratorium maps as primary forest within these two concessions. Greenomics Indonesia points out that,

If this primary forest is not excluded from the two MIFEE clusters (IV and X) so that it can be made subject to the moratorium separately, then it is clear that its integrity will be seriously threatened by its conversion to other uses, particularly for the development of palm oil plantations.There is another twist to the MIFEE and the moratorium tale. One of the companies involved in the MIFEE development is the MEDCO Group, a huge Indonesian holding investment firm (its main business is oil and gas). Korea’s second largest corporation, LG, is reported to be running MEDCO’s plantations in Merauke.

REDD-Monitor is offering no prizes for guessing which country’s sovereign wealth fund owns shares in both Medco Energi International and LG International. Step forward the Norwegian Government Pension Fund Global.

In a presentation last week in a meeting about illegal logging at Chatham House in London, Jago Wadley, Senior Forest Campaigner at Environmental Investigation Agency, highlighted the hypocrisy of the Norwegian government’s claims to be reducing deforestation while at the same time investing in forest destroying companies. His presentation, titled “Norwegian Woods: Exploring Norway’s Contradictory Financial Incentives in South East Asia’s Land Use Sector”, can be downloaded here (pdf file, 2.2 MB).

In his presentation Wadley quotes Norway’s prime minister, Jen Stoltenberg as saying, “In today’s global markets, forests are worth more dead than alive.” Stoltenberg said this in 2010, at the Oslo Climate and Forest Conference, that saw the signing of the Letter of Intent between Norway and Indonesia. Stoltenberg continued by saying, “Today we commit to change that equation. It must pay off not to cut a tree, but leave it standing.”

Almost two years later, Norway is cynically proving that Stoltenberg’s first statement remains true and that Norway actually committed to nothing. Wadley looks at the Norwegian Government Pension Fund Global’s (GPFG) profits during 2010 from 29 companies in Indonesia and Southeast Asia that are involved in forest destruction. In December 2009, the value of GPFG’s investment was US$437 million. By December 2010, the figure had increased to US$678 million – as a result of US$96 million new investment and an increase of US$145 million profit. During the same period, Norway handed over US$30 million to Indonesia under the two country’s big REDD deal.

In other words, profits from Norway’s investments in forest destruction were almost five times as high as the payment aimed at reducing deforestation. By 2014, GPFG profits from plantation companies in Southeast Asia could amount to more than US$1.5 billion. As Wadley points out,

Norway could make 50% more from Asian plantations companies over five years than it might pay Indonesia for REDD over a similar period.And that’s without taking into consideration Norway’s investments in coal, mining or oil and gas.