Betting the farm – and winning

- Macleans

- 17 Mar 2011

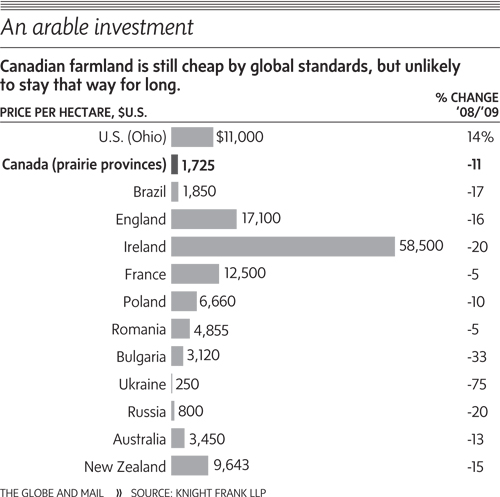

Investors are buying Canadian agricultural land, betting that rising food prices, a ballooning global population and growing worldwide scarcities in farmland will mean a payoff for them.

Investors are buying Canadian agricultural land, betting that rising food prices, a ballooning global population and growing worldwide scarcities in farmland will mean a payoff for them.

AgCapita's Stephen Johnston says Brazil's "sudden hostility to foreign farmland ownership" should make "developed markets such as Canada" more attractive to investors

"Foreign governments and institutional investors have only recently been moving into the space and in a very limited way and yet they have already generated considerable controversy and political backlash where they have deployed capital into the emerging markets. We believe that this will only become worse over time," says Agcapita's Stephen Johnston.

Libyan leader Moammar Gadhafi calls it the “new feudalism.” Groups representing peasant farmers call it “land grabs.” The United Nations literature dispersed at this week's UN food summit in Rome calls it “direct foreign investment.”

Hancock Agricultural Investment Group, a Boston-based unit of Toronto's Manulife Financial Corp., decided its first Canadian purchase would be an 1,100-acre (450-hectare) patch of land that it called "one of the most highly productive properties in the industry." The company will not disclose how much it paid, or even the exact location of the farm. But president Jeff Conrad said the company is in Canada to stay, and the fund plans to seek more land.

According to Steve Yuzpe, the CFO of Sprott Resource, ongoing population growth, dwindling arable land, water issues, even the falling yield productivity delivered by genetically modified seeds will be the big drivers for continued record demand—pushing food prices ever higher.

Direct investment in farmland has outperformed stock and bond returns over various timescales with substantially lower volatility than the US equity market, according to Stephen Johnston of Calgary-based Agcapita Partners

While everyone from the Rothschild’s – via the Agrifirma Brazil fund, run with Jim Slater – through to Nicola Horlick and UBS are snapping up farmland in Brazil, I’m fascinated by another niche: Canada and New Zealand.

While ordinary Canadians watch their pensions and jobs evaporate in the global economic mess, those who brought us the crisis have found a new profit-making toy. It’s land-grabbing, 21st-century style. Canada is not being spared.

Soros recently became the largest shareholder in Adecoagro one of the leading agribusiness companies in South America whose main activities are the production of grains, rice, oilseed, dairy products, sugar, ethanol, coffee, cotton and cattle meat.

From Kansas to Kenya, investment opportunities in a range of global farm-related ventures are increasingly drawing capital to what many players and analysts see as the early days of a burgeoning bull market in agriculture.

As world population expands, the demand for arable land should soar. At least that's what George Soros, Lord Rothschild, and other investors believe.

|

HAGL raises $51mln from private placement

|

|

Pakistan sweetens terms to lure Saudi investment

|